Selling property below Guidance Value?

If you are thinking of buying or selling a property, you should first understand your tax liability.

We have put down the tax liability for both the Buyer and the Seller in the case of buying or selling at a price which is lower than the Guidance Value.

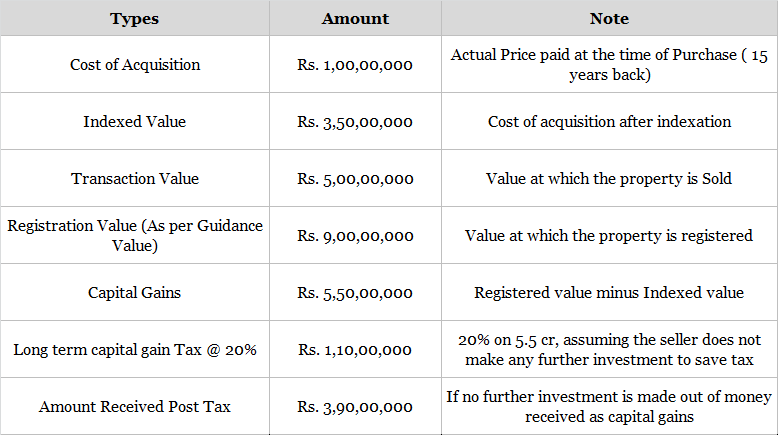

Tax Liability of the Seller

References: Section 52 and Section 52 (2)(10) of the income tax law, amendment in Budget 2013 and Budget 2018

If a Seller sells a property at a price which is lower than the guidance value, then capital gains is calculated as per guidance value

Example:

Lets say you sold a property which you bought for 1 cr, 15 years back , for 5 Cr Today. However as per the current guidance value, the property is being registered at 9 Cr.

In order for you to save 100% tax, you will have to reinvest 5.5 cr in another property.

In order for you to save 100% tax, you will have to reinvest 5.5 cr in another property.

Exceptions:

- If the IT officer gets an independent evaluator to evaluate the property, then the value prescribed by the Independent Evaluator will be considered as the value at which the property will be registered. Hence the tax calculation will be as per the value prescribed by the evaluator.

If you are a Buyer, then click here to know your tax liability.

Palm Meadows Guidance Value: Click Here

Submit details to redirect to the calculation sheet