Buying property below Guidance Value?

If you are thinking of buying or selling a property, you should first understand your tax liability.

We have put down the tax liability for both the Buyer and the Seller in case of buying or selling at a price which is lower than the Guidance Value.

Tax Liability for the Buyer

Tax Liability for the Buyer

References: Section 52 and Section 52 (2)(10) of the income tax law, amendment in Budget 2013 and Budget 2018

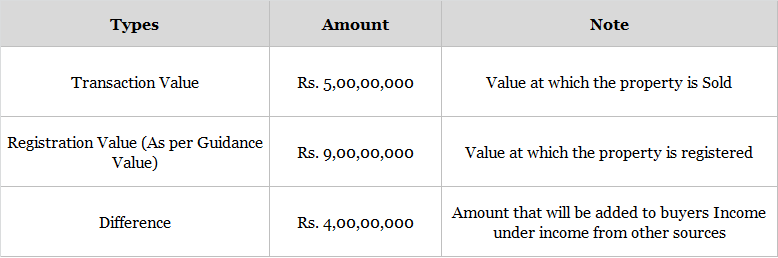

If a buyer buys a property at a price which is lower than the Guidance value, then the difference between the actual sale value ( Sale consideration) and the Registered value (guidance value) will be considered as “Income from Other Sources”. This will be added to the buyers income and will be taxed as per the slab that the buyer falls under.

Example:

Lets say you buy a property for 5 Cr which comes to 9 Cr as per the guidance value.

5 Cr + 1.6 Cr(40% of 4 Cr) = 6.6 Cr considering the buyer has to pay 40% income tax, the net cost of acquisition of the property will be

Exceptions:

- If the difference is less than 10% of the sale consideration, then IT is not applicable. In the above case if the property is bought at 8.1 Cr and registered at 9 Cr, then the difference of Rs. 80 lakhs will not be considered as income from other sources and no tax will be applicable on the same.

- If the IT officer gets an independent evaluator to evaluate the property, then the value prescribed by the Independent Evaluator will be considered as the value at which the property will be registered. Hence the tax calculation will be as per the value prescribed by the evaluator.

Silver Lining:

When the buyer plans to sell the property at a future date, then the value at which the property is registered will be considered as cost of acquisition. Hence in the above example, 9 Cr will be considered as your cost of acquisition of the property and not 5 Cr. This will help with the capital gains liability that may arise at the time of selling.

If you are a Seller, then click here to know your tax liability.

Submit details to redirect to the calculation sheet